What Everybody Ought To Know About How To Apply For A Fannie Mae Loan

/GettyImages-131966314-a259153a4b1e46a7a26fa5e523ce36dd.jpg)

List name(s) of other borrower(s) applying for this loan.

How to apply for a fannie mae loan. 1 know when you’re ready. Federal housing finance agency. Cancellable mi once the borrower’s equity reaches 20% (restrictions apply).

For borrowers putting in sweat equity to their homes for homeready loans, fannie mae no longer requires a 3% personal funds contribution nor caps the sweat equity contribution towards a down payment. Before deciding on one, get to know the options available and which may be best for you. That debt cancellation could come as soon as this year.

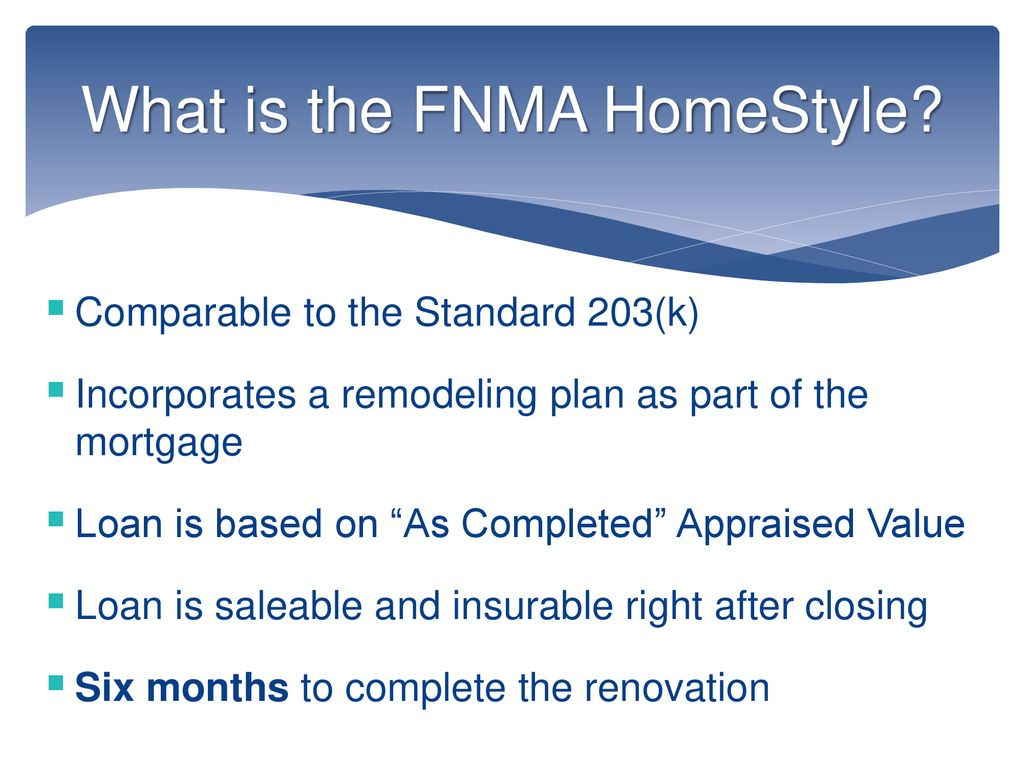

3 work with a mortgage lender. You might also be eligible for refinow ™ — an option that can lower your interest rate and reduce monthly payments. The down payment required for a homestyle® loan will vary based on the number of units within the home and how the property is occupied.

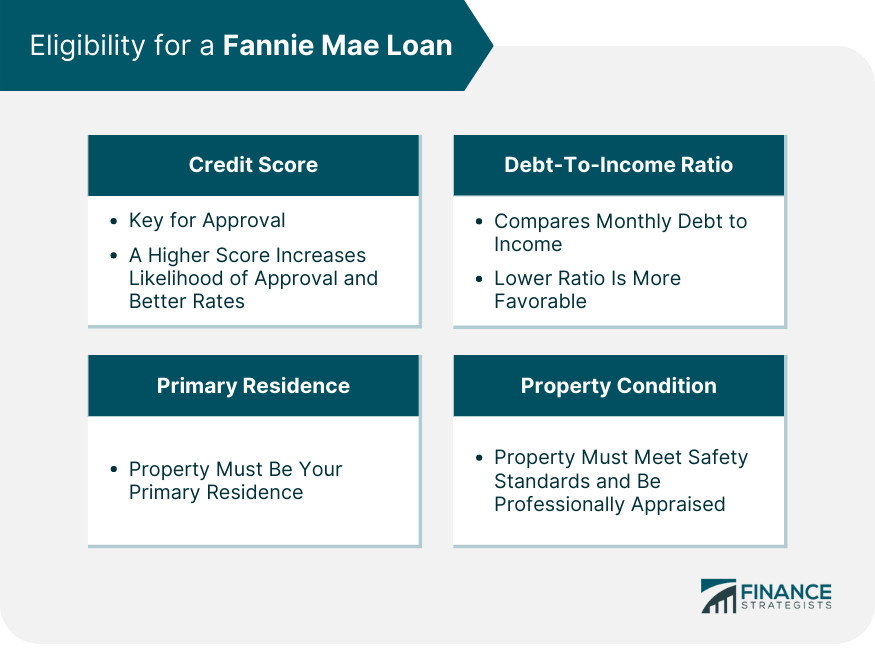

In order to qualify for this renovation loan, borrowers themselves have to meet several guidelines, including the following: Desktop underwriter & desktop originator.

Understanding home loan basics before you buy. Deliver renovation loans prior to project completion by becoming an approved homestyle renovation lender. Because fannie mae doesn’t directly lend money to consumers, borrowers who want to use a homestyle loan must first find a lender who offers this type of loan product.

What is the fannie mae homepath program? Buy a home and fix it up with fannie mae’s. Loan limits for conventional mortgages.

By clever real estate updated october 21, 2021. You cannot apply directly for a fannie mae loan, but in order to receive a good loan, you will often need to prove to your lenders that their investment will be backed by fannie mae. The path to securing a mortgage can be confusing.

Homeready quick start guide. There are many financing options available to those looking to purchase investment properties. 6 get ready to close your loan.

The document details the borrower requirements for all fannie mae loans. Where can you find freddie mac home possible guidelines? Conforming loan limits. fannie mae.

Borrowers can check fannie mae income limits with the company’s area median income tool. We also asked lenders to identify the risk areas for which their concern levels have increased the most over the past year: Once the loan closes, fannie mae buys loans that meet its requirements from lenders.