Build A Tips About How To Buy Paper Savings Bonds

You can only purchase paper bonds by requesting.

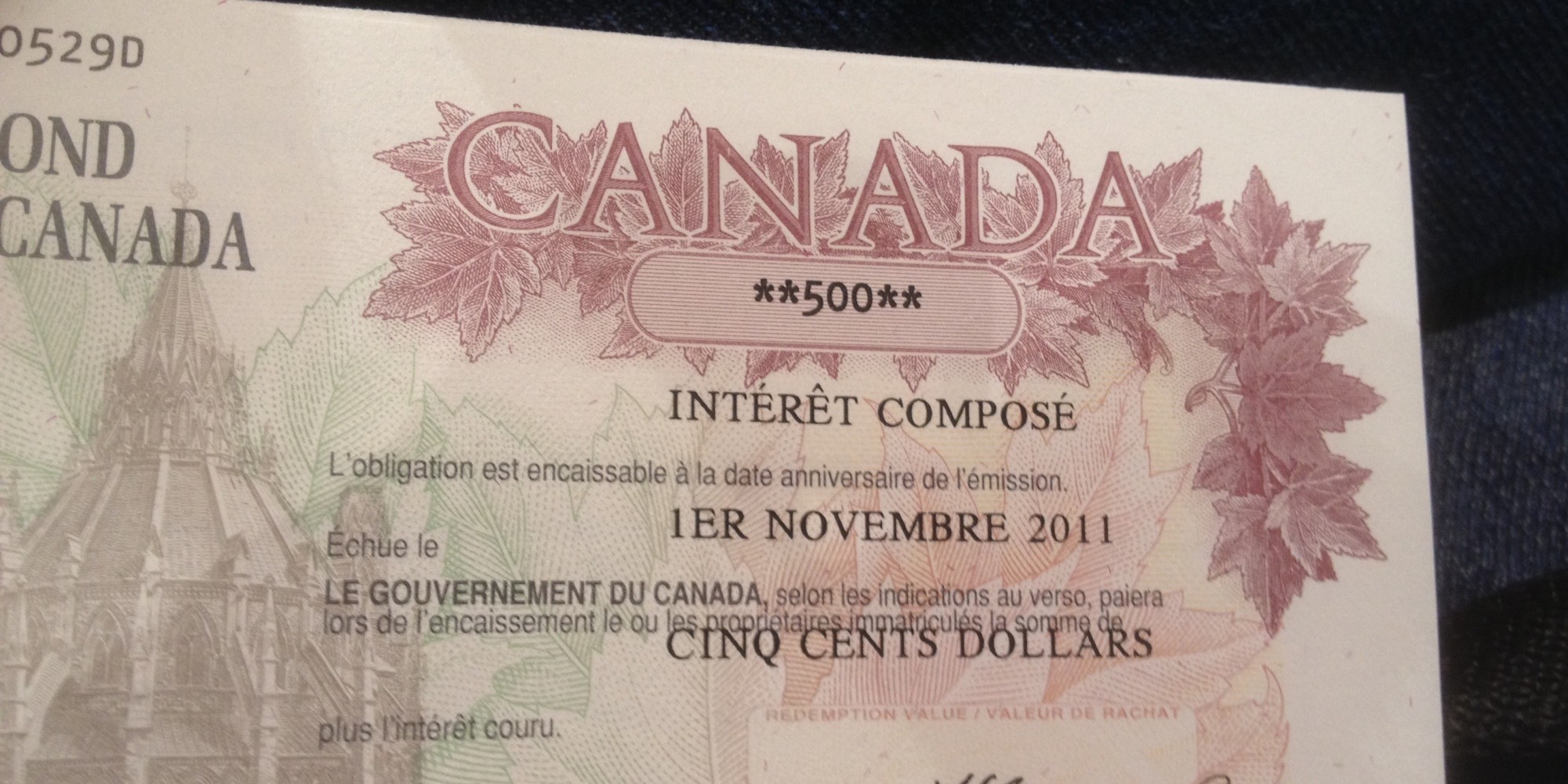

How to buy paper savings bonds. Paper i bonds have a minimum purchase amount of $50 and a maximum of $5,000 per calendar year. These can be bought directly over the counter (otc) or via the asx through a broker or an online trading account. There are two main types:

Fill out the rest of the information. Go to your treasurydirect account. When you buy a savings bond, you're essentially lending money to the us government, which promises to repay you within 30 years.

Click the 'get started' link on the savings bond calculator home page. Select the type and denomination of bond you wish to purchase. Fill out a purchase application and pay for the bond.

Choose whether you want ee bonds or i bonds, and then click submit. To learn more about redeeming a paper u.s. You’ll have to file your income tax return with the internal revenue service (irs) in order to buy paper bonds.

Ee, e, i, and savings notes. There is now only one way to obtain paper series i savings bonds: You can buy them in increments of $50, $100, $200, $500.

In any single calendar year, you can buy up to a total of $5,000 of paper i bonds using your refund. You must buy them through the internal revenue service using your income tax refund. I savings bonds and ee savings bonds.

The actual bond will be. To find what your paper bond is worth today: The face value of these types of bonds is fixed.

Once open, choose the series and denomination of your. To buy a savings bond in treasurydirect: The calculator will price series ee, series e, and series i savings bonds, and savings.

Find out what your paper savings bonds are worth with our online calculator. Paper savings bond calculator find out what your paper savings bonds are worth! I savings bonds are a liquid savings.

The calculator will price paper bonds of these series: You buy i bonds at face value, meaning if you pay $50 (using your refund), you. For information on registration, see registering your bonds.

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png)