Smart Tips About How To Buy Tax Exempt Bonds

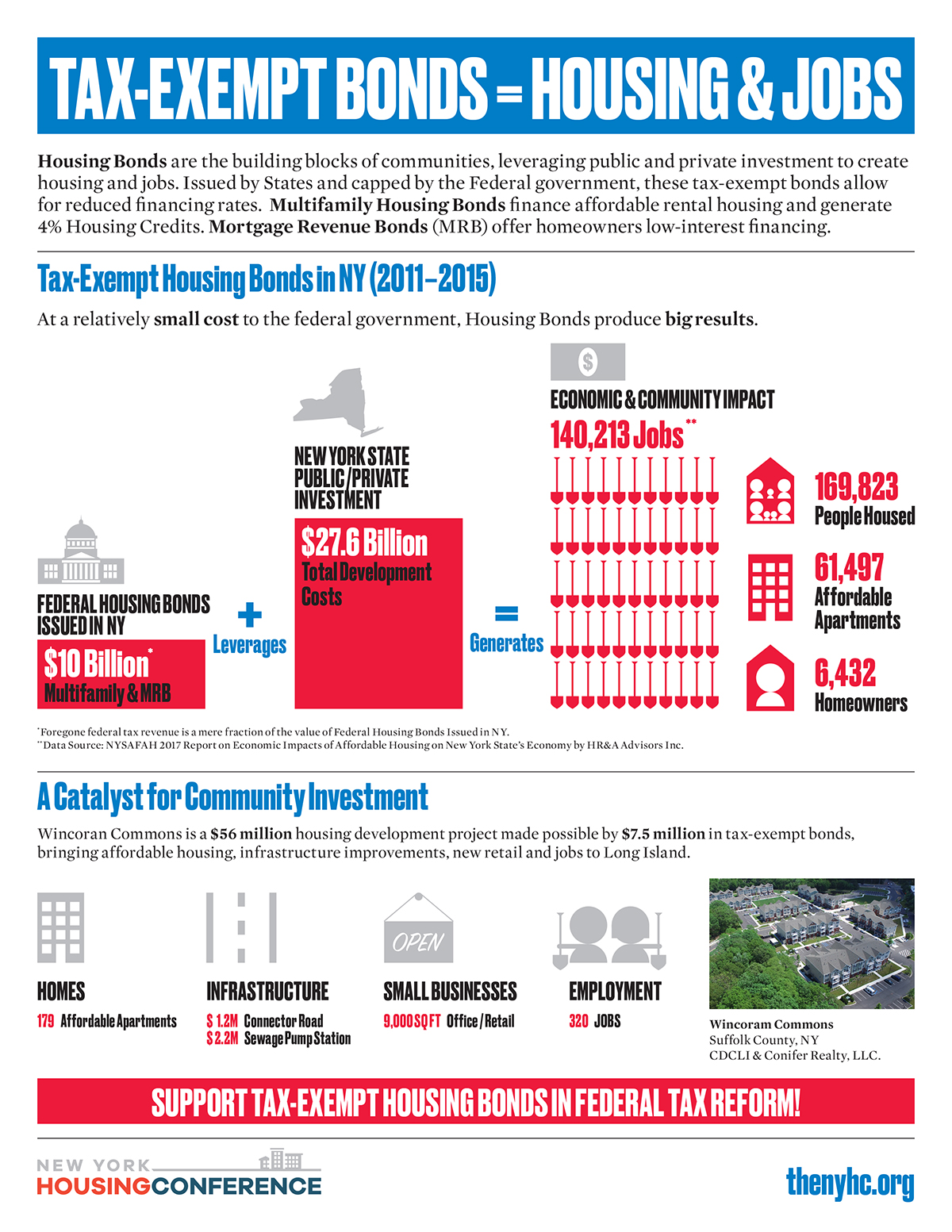

Learn why muni bonds attract investors looking for tax free income, less risk, or the growth.

How to buy tax exempt bonds. Interest from bonds used to finance sports facilities or fund public pensions are. Resources for issuers, borrowers and bond professionals. The potential to lose money is not as great as with stocks, but it’s palpable.

(1 min) the tax bill is coming due for one of the hottest investments of the past two years. Am i investing outside of an ira or another retirement plan? Method 1 buying u.s.

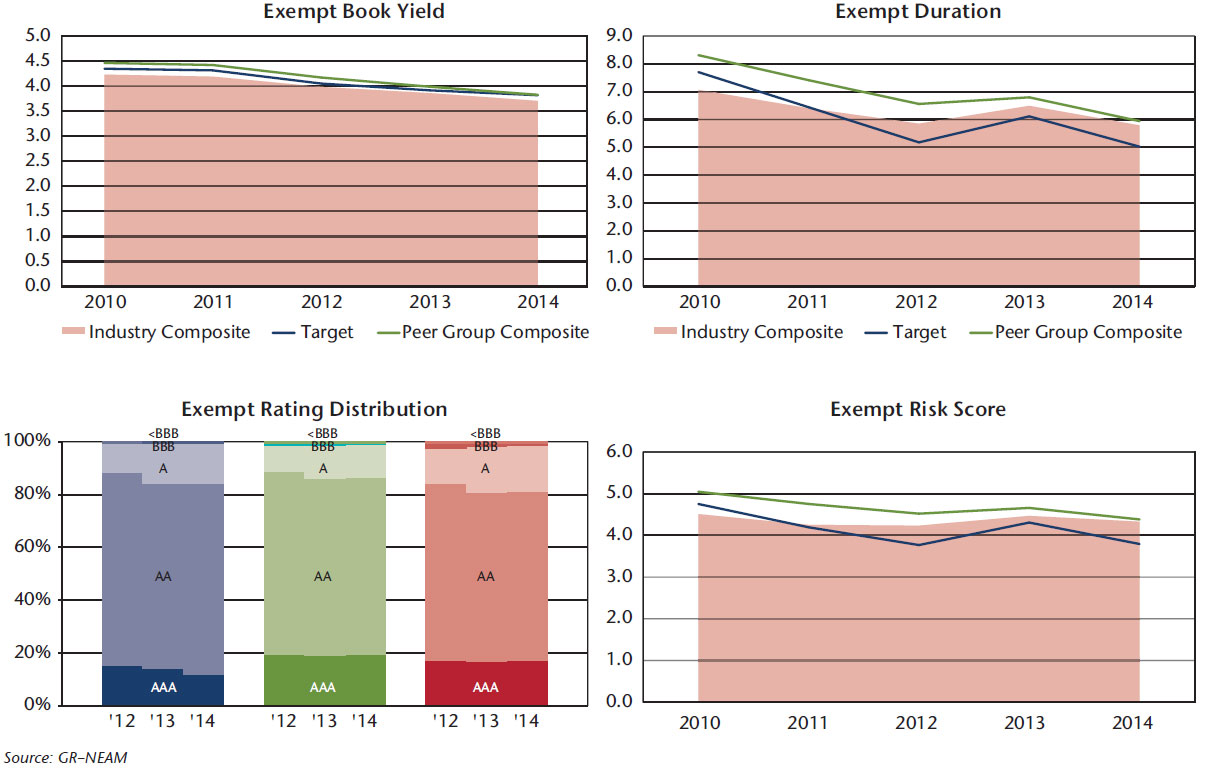

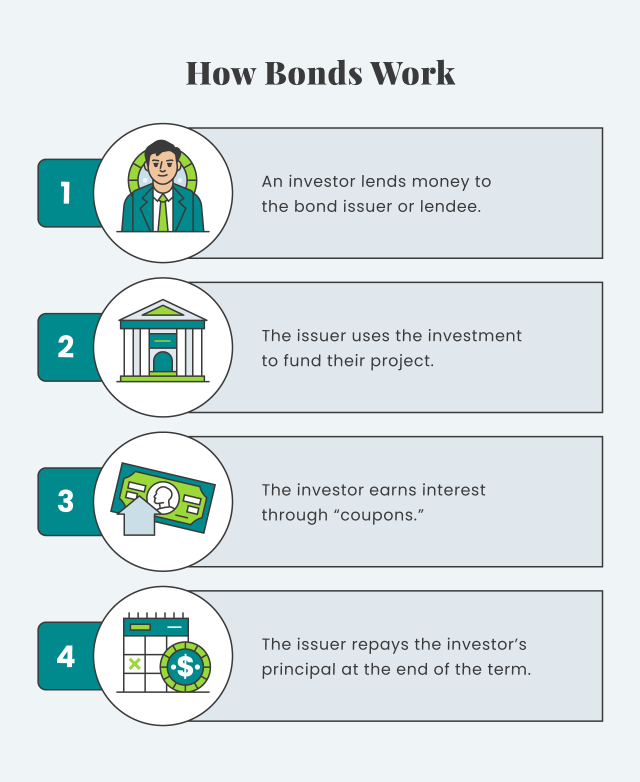

Interest income generally federally tax exempt low level of default risk relative to other bond types find municipal bonds find bonds types features & benefits risks in. An investor can buy and sell bonds directly through an online brokerage account. Purchasing the bond at a discount of less than $125 means the discount will be taxed at a capital gains rate of 0%, 15%, or 20%, depending on your income.

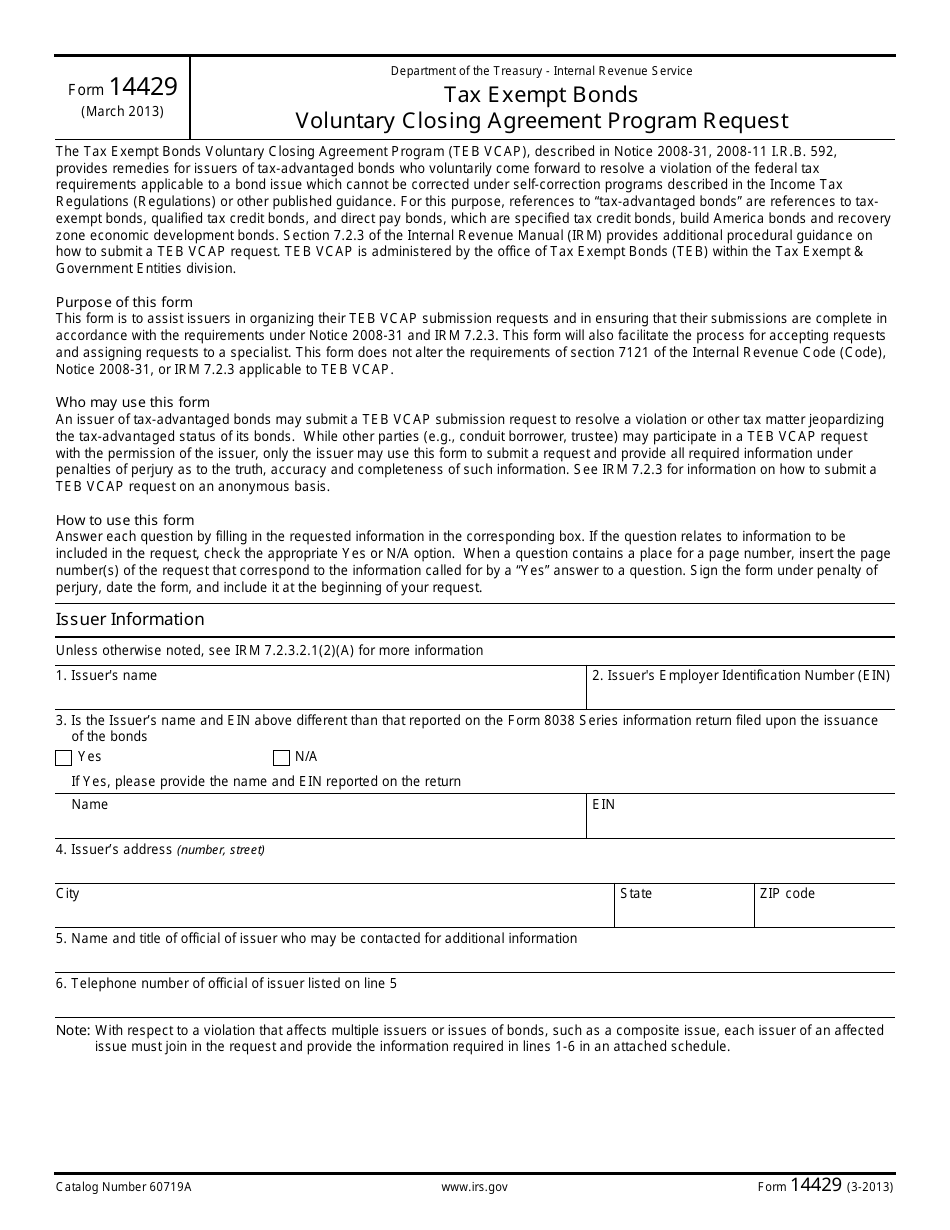

Tax credit and direct pay bonds. Choose a financial organisation with a solid market reputation. Invesco floating rate municipal income etf ( pvi) 0.25%.

If he chooses to file a bond, he will likely have to pay a 20 percent deposit ($16.66 million) and put up collateral, but it could come with fees and interest, making it. When an investor buys a municipal bond, they're willing to forgo a higher yield on their investment dollars in exchange for not having to pay taxes on the gain. Treasurydirect is the secure online system that the u.s.

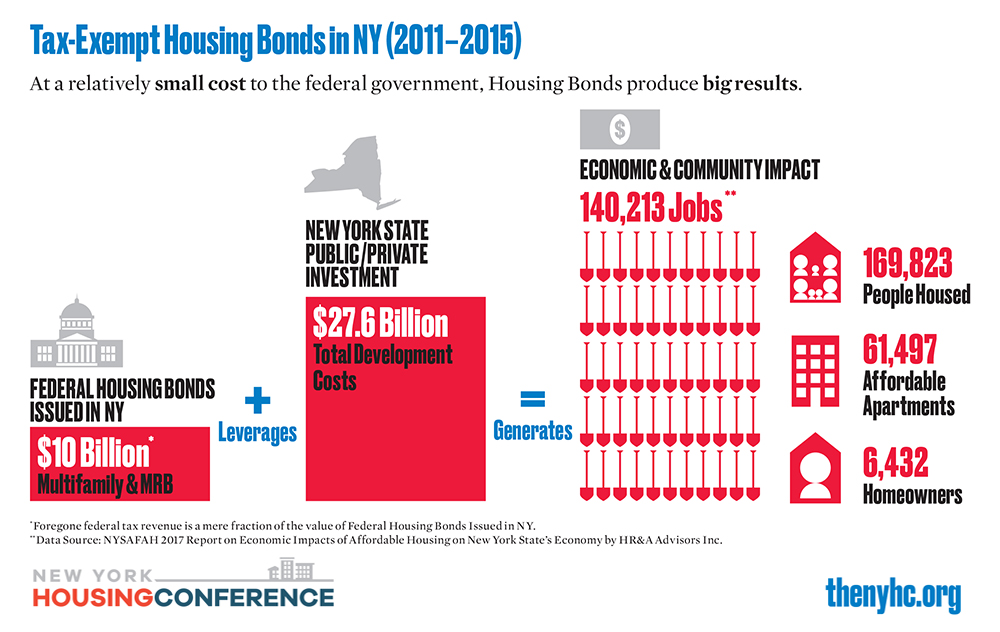

To compare municipal bonds to taxable bonds, you need to. Interest paid on municipal bonds can be exempt from federal, state, and local taxes. It owns 889 bonds with an average time to.

Treasury bonds through treasurydirect 1 open a treasurydirect account. Ishares national muni bond etf ( mub). Ishares new york muni bond etf ( nyf) 0.25%.