Smart Info About How To Claim Income Tax Rebate

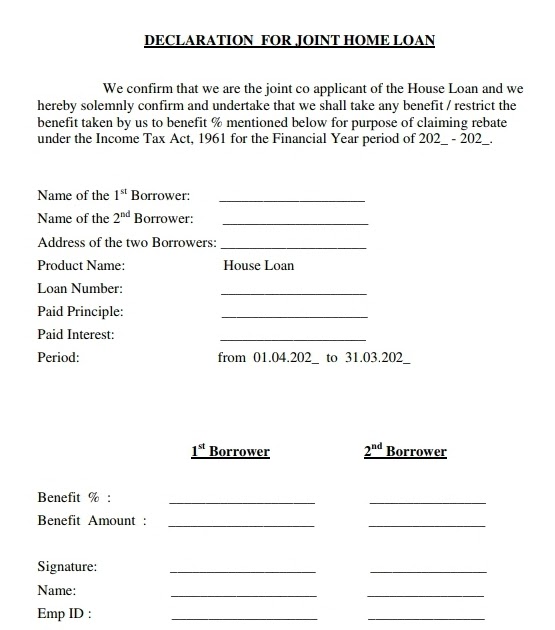

Schedule to income tax act (e.g.

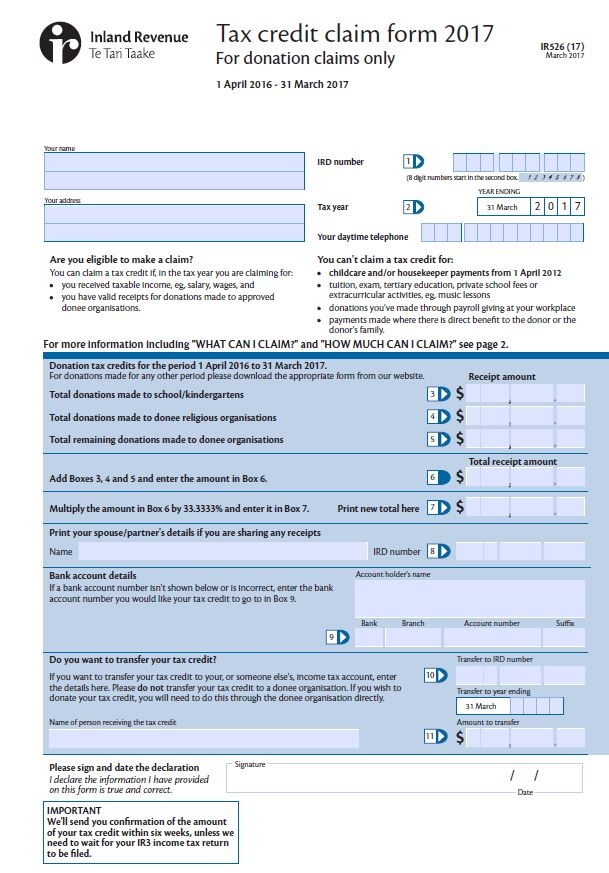

How to claim income tax rebate. The most common reason for a tax rebate is when you have paid too much income tax. The fastest way to get your tax refund is to file electronically and have it direct deposited, contactless and free, into your financial account. It’s important to keep part 1a for your records.

You can check your income tax refund status through. Find out how to pay less tax! The fastest way to get your tax refund is to file electronically and have it direct deposited , contactless and free, into your financial account.

Go to the get refund status page on the irs website, enter your personal data then press submit. Internal revenue service (irs) and can be claimed with your federal income taxes for the year. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the number.

Now under the relevant assessment year for. Voluntary disclosure of errors for reduced penalties. Earned income credit:

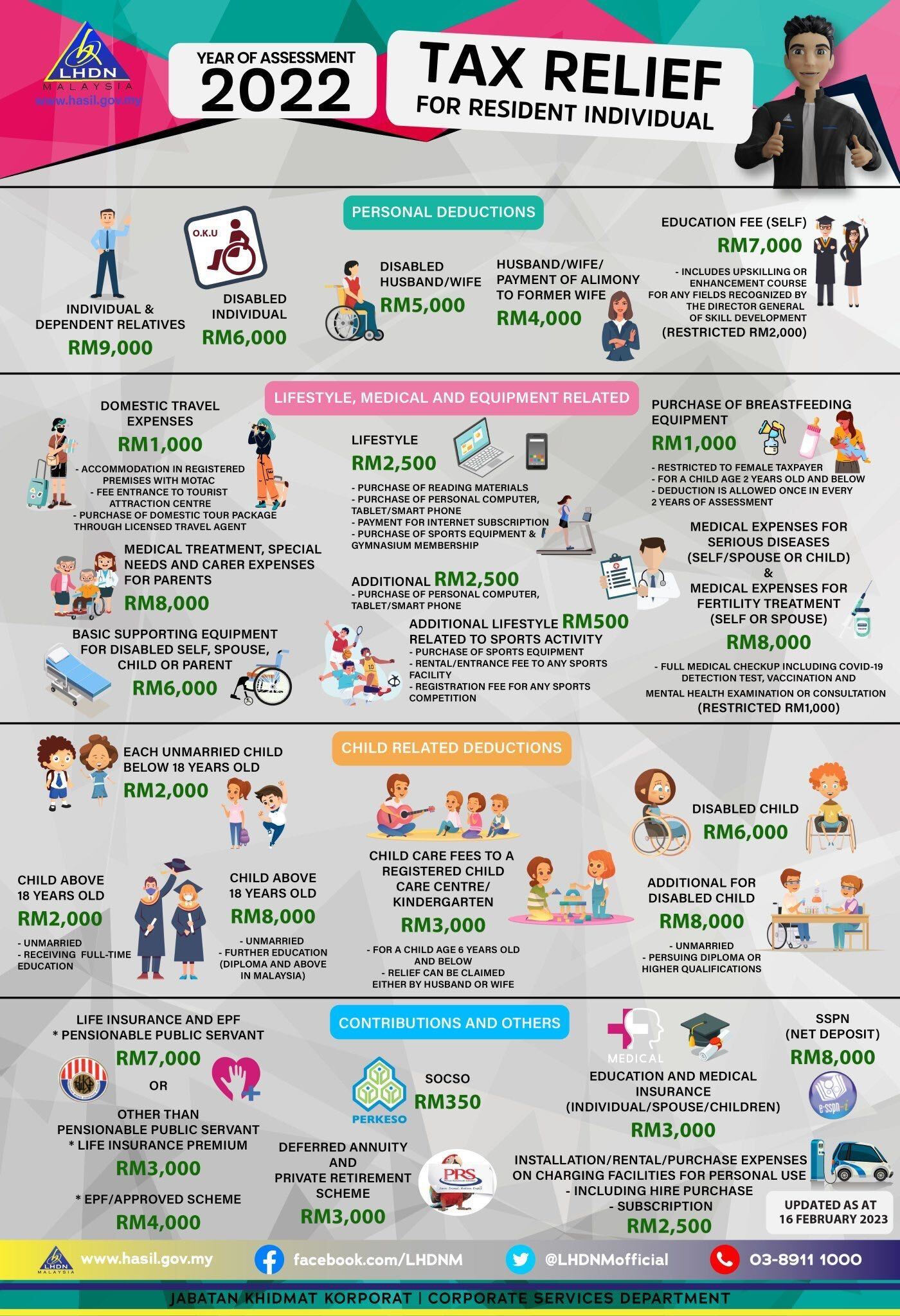

This section is designed to provide relief to taxpayers with income. These credits are managed by the u.s. Retrenchment) reflect under code 3915.

Forgot to claim tax reliefs or deductions. Tax rebate is a refund on taxes when the tax liability is less than the taxes the individual has paid. Learn more on tax reliefs, deductions & rebates.

If you did not receive the full amount of eip3 before december 31, 2021, claim the 2021 recovery rebate credit (rrc) on your 2021 form 1040, u.s. This video looks at how you can view, manage and update details and claim a tax refund using the hmrc app. You can claim your tax refund online using the government gateway site.

You may be able to get a tax refund (rebate) if you’ve paid too much tax. You’ll need to send the benefit office parts 2 and 3 of your p45 to claim your tax refund. 2020 recovery rebate credit:

When your third economic impact payment is scheduled, find when and how. To find out more about the hmrc app on gov.uk. To get a refund on any overpaid.

The maximum tax rebate amount is ₹12,500. Taxpayers usually get a refund on their income tax if they have paid more.